Navigating the Financial Maze: Your Quest to Success with QuickBooks

Did you know that managing your personal finances is a lot like managing your business finances? In today’s rapidly changing world, one thing remains constant: the challenge of handling money effectively, whether you’re an individual seeking financial security or a business aiming for success. But there’s good news! QuickBooks is here to help you on your financial journey, whether it’s for personal or business purposes.

Why QuickBooks?

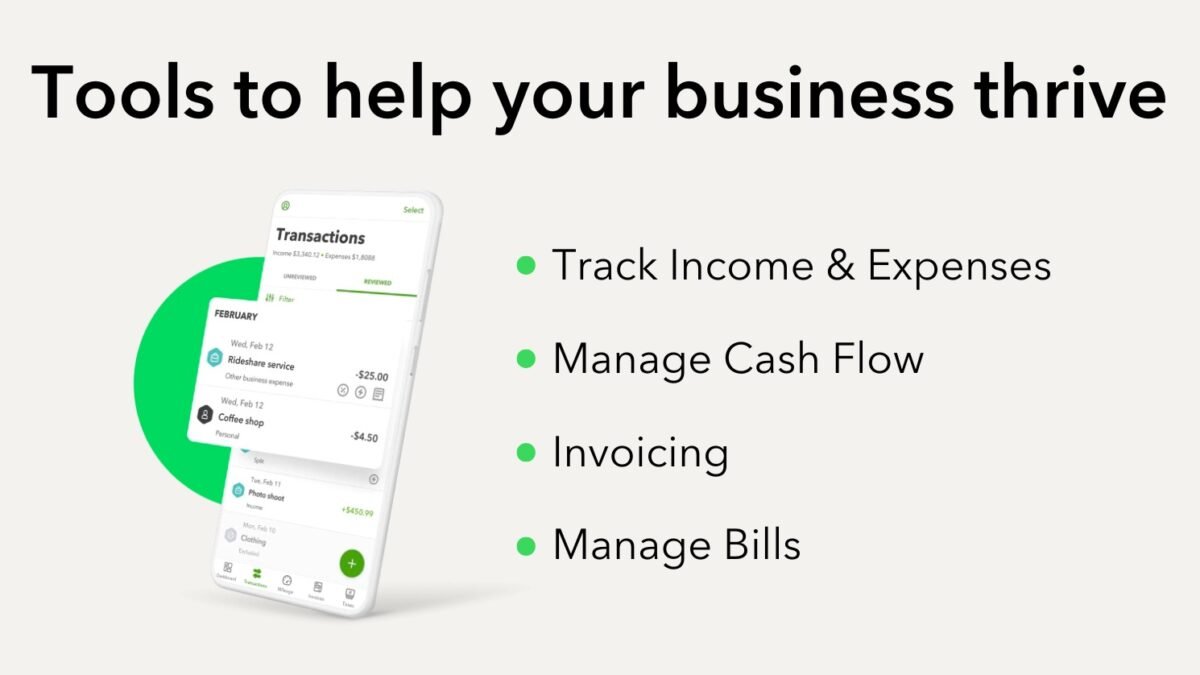

Imagine this: You, the fearless entrepreneur, setting out on a quest for financial success. Just as individuals have tools like my800Credit and the Dispute Wizard to navigate personal finances, QuickBooks steps in as the ‘wizard’ for managing income, expenses, and cashflow. It’s the secret ingredient that can elevate your financial insights, whether for personal or business use.

In recent years, there has been a surge in entrepreneurial ventures. Small business owners, especially those who may not be financial experts, play a crucial role in shaping America’s future. Small businesses create 1.5 million jobs annually and account for 64% of new job opportunities in the United States. Understanding the significance of their success, let’s consider some initial steps when you feel that spark to start your entrepreneurial journey:

- Assess Market Demand: Determine if there’s a need for your product or service.

- Showcase Uniqueness: Identify what sets your offering apart and fulfills that need.

- Manage Personal Finances: Examine your personal financial situation and plan how to fund your business as you start this exciting journey.

- Adapt to Change: Given the evolving business landscape, consider how changes might affect your niche.

If you’re confident and ready to start your own business, using QuickBooks from the beginning is a wise choice. It helps you track all the financial aspects of starting a business. This is especially important because, initially, personal and business finances can get mixed up, and monitoring every dollar is crucial. In future posts, we’ll delve into the importance of building business credit, but that comes after you’ve set up your business, started operations, promoted it, and started generating income.

Remote Work, Made Magical

In today’s world, remote work is prevalent, with 60% of employees working remotely. But managing a remote workforce, even if it’s just you, can be challenging, especially with payroll and taxes. Enter QuickBooks Online Payroll, your reliable solution!

QuickBooks Online Payroll makes payroll management easy, seamlessly integrating with QuickBooks Online. It simplifies paying your employees and managing financial data, freeing you from tedious tasks.

Unlock Exclusive Savings

Discover a treasure trove! Use this link to get an exclusive offer: 30% off QuickBooks Online Payroll for 6 months, 20% more savings than the standard website offers. It equips you to conquer financial challenges while keeping your budget in check.

Maximize Your Wealth

QuickBooks is like a wise sorcerer, revealing hidden treasures in your business finances. It manages your wealth flow, ensuring you don’t miss out on deductions and other benefits. With QuickBooks, you’re not just managing finances; you’re creating savings and wealth!

In conclusion, QuickBooks isn’t just a financial tool; it’s your loyal companion on the journey to financial success. Whether you’re a small business owner or part of a larger enterprise, QuickBooks streamlines operations, saves time, and enriches your finances. Don’t miss this opportunity – start your financial journey with QuickBooks today! 🚀”