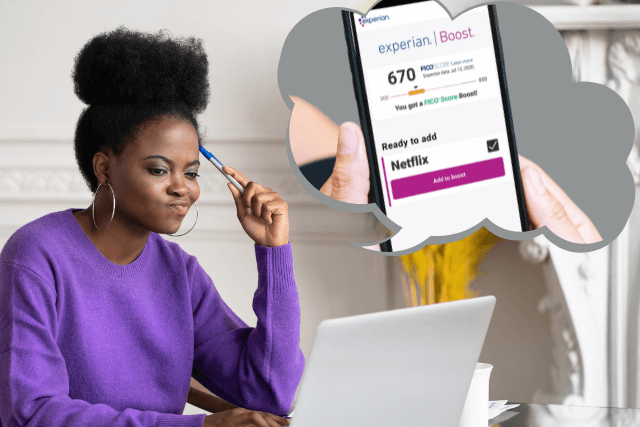

Should You Use Experian Boost?

When it comes to trying to improve your credit, there are a lot of different strategies you can employ. Some credit improvement techniques involve you paying down credit card balances or having a friend or loved one add you as an authorized user on a positive credit card account. These strategies have been around seemingly forever. One of the newest options, only a few years ago, was introduced by one of the major credit bureaus, Experian. They call the service, Experian Boost. But, are there real advantages and should you use Experian Boost?

What Is Experian Boost?

Experian Boost is a free service that allows you to provide certain types of data to the credit reporting agency, Experian. The data you share is information that doesn’t traditionally show up on your credit reports and is not furnished directly by any particular creditor or service provider.

Traditionally, the information on your three credit reports comes from businesses called data furnishers. These are the 11,000+ companies that share account information with the three major credit bureaus and which are normally financial services companies or debt collectors. Experian Boost gives you the ability to add information to your Experian credit report yourself.

Currently, there are three types of accounts you can voluntarily add to your Experian credit report:

· Mobile Phone Accounts

· Utility-Style Accounts (like satellite T.V. or cable)

· Certain Streaming Services (like Netflix)

According to Experian, the average user of Experian Boost who received a credit score increase saw their FICO8 Score improve by 12 points. But, the credit bureau does warn that not everyone who uses the program will experience credit score improvement.

NOTE: Accounts added through Boost cannot lower your scores. So, if you do add accounts then your score impact will be either neutral or positive, but never negative.

How Experian Boost Works

When you opt into Experian Boost, you will first verify your personal information and give the credit bureau permission to connect to your personal bank account. From there, Experian uses technology created by a company called Finicity to search your bank account history for key types of payment information. If the program discovers payments on eligible telecommunications or utility-style accounts, it can add those tradelines to your Experian credit report. However, you get to choose which eligible accounts you want Experian to add to your credit report and which accounts (if any) you want the credit bureau to exclude. This is what’s commonly referred to as consumer-controlled information because you decide what gets added, and what does not get added.

Once a new account or accounts appear on your Experian credit report, the accounts can now be factored into credit scores that are 1) based on your Experian report and 2) consider utility-style accounts. Experian research shows that the program may be most beneficial to consumers with thin credit files and those looking to rebuild their credit. According to Experian:

· 10% of consumers with thin credit files qualified for a credit score after signing up for Experian Boost. Boost turned them from an un-scorable to a scorable file.

· 75% of consumers with a FICO® Score under 680 experienced credit score improvement after using the program.

· Between 5%-15% of consumers moved to a better FICO Score category after opting into Experian Boost. This means the consumer moved to a more attractive risk tier which could possibly lead to more favorable treatment from lenders.

While the statistics are impressive, keep in mind that they only apply to Experian credit reports and the FICO and VantageScore credit scores generated based on Experian data. The other two major credit bureaus—Equifax and TransUnion—and FICO and VantageScore credit scores calculated from their data are not going to benefit from Experian Boost.

NOTE: Not all FICO score generations will consider utility-style information. FICO 8 and the more current FICO score generations will consider utility data, and all VantageScore generations will consider utility data.

Why You Should Consider Using Experian Boost

Good credit can have a meaningful impact on your financial life. We all know this. With good credit scores, it’s easier to qualify for loans, credit cards, and other types of financing. Good credit is also key if you hope to secure favorable terms and interest rates when you borrow money. And, less money paid to lenders in the form of interest means more money that stays in your pockets each month.

Experian Boost represents a free and easy way to potentially improve one of your three credit reports. If the program helps you add positive accounts to your Experian credit report, any credit scores based on that information might increase as well. Plus, if you change your mind about the service, you can always withdraw from Experian Boost at your convenience. Considering these facts, there’s little downside to giving Experian Boost a shot.