What Is Risk-Based Pricing and Why It Matters To Your Credit

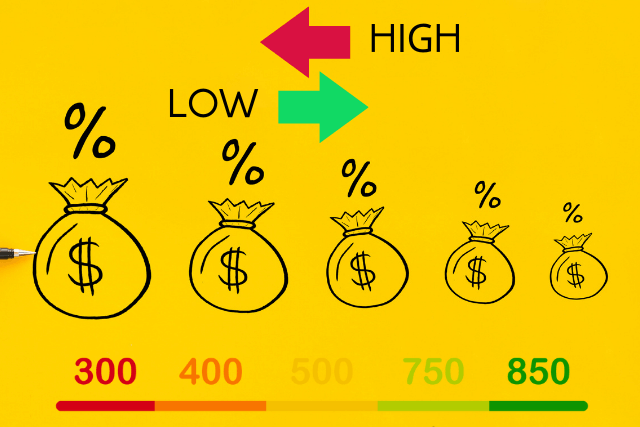

You already know that your credit scores help to determine whether a lender approves or denies your credit applications. Yet, just because you can qualify for a loan or a credit card account doesn’t mean a lender is done considering your credit quality. Your credit scores also influence the financing terms a lender or credit card issuer is willing to offer—including the interest rate and fees you pay to borrow their money.

This process of lenders using credit to set the terms of financing products is called risk-based pricing. And, because risk-based pricing is common practice in the credit industry, it’s important to maintain the best credit possible. So, what is risk-based pricing and why it matters to your credit.

What is the relationship between credit scores and interest rates?

When a lender reviews a new loan or credit card application, it tries to determine whether you (the applicant) are a good enough credit risk for their taste. Are you someone who is likely to repay the money you borrow according to the terms of your agreement? Or, is there an unacceptable chance you might fall behind on your payment obligations?

Credit scores help lenders predict your future payment behaviors. A good FICO credit score or VantageScore credit score indicates to a lender the likelihood that a consumer will pay 90 days (or worse) late within the next 24 months. This is called a Performance Definition, or a credit scoring model’s stated design objective.

Lenders can limit their risk by charging interest according to a borrower’s level of credit risk. If you have good credit, you should qualify for a more attractive interest rate because there is less of a need to subsidize for your risk. But, borrowers with lower credit scores will likely have to pay a higher interest rate to account for the added risk the lender is willing to accept. The alternative, of course, is to just deny your application altogether.

Risk-based pricing examples

On the surface, the difference between a few percentage points might seem insignificant. Yet, an APR that’s even half a percent lower could potentially add up to significant savings—especially with large loans amortized over a long period of time multiplied by millions of borrowers.

Here’s an example of how a mortgage lender might set the APR on a 30-year fixed-rate mortgage loan according to your credit score (and how much those different interest rates could cost you). Note: The loan amount in the example below is $380,000, keeping in line with the median home sales price of $379,100 in October 2022 according to the National Association of Realtors.

Source: myFICO Loan Savings Calculator

Based on the example above, a FICO Score of 620, which is almost 100 points below the national average, could cost you an extra $348 per month compared with a FICO Score of 720, which is barely above average. Comparing those same two FICO Scores (620 vs. 720), the lower score in this scenario could cost you an additional $125,493 over a 30-year loan (assuming you didn’t refinance or sell your home).

This is how lenders subsidize against added risk. They’re willing to do business with you, but they want more profit in exchange. So, if you ever wondered the actual mathematics behind why people with higher scores get better deals, look no further than the above example.

Bottom line

The bottom line is, well, the actual bottom line. Risk-based pricing is a standard practice among lenders to make more money when they take on added risk. Therefore, it’s in your best interest to earn and maintain solid credit scores.

Even if you don’t plan to apply for financing anytime soon, good credit could benefit you in other ways. With good credit, you may be able to get lower rates on insurance, receive higher credit card limits, set up new utility or mobile phone services with ease, and more.

It can take some effort to earn solid credit, especially if you’re working to overcome past credit mistakes. Yet in the long run, the perks of having solid credit scores are well worth the effort it takes to earn them.