December 15, 2023

Introduction: Amazon, the e-commerce superstar that offers nearly everything under the sun, has become a target for scammers. In fact, it’s so popular that scammers are […]

November 27, 2023

“Prehired will void all outstanding income share agreements, refund harmed borrowers, and permanently cease operations” In a recent announcement, the Consumer Financial Protection Bureau (CFPB) […]

November 17, 2023

Why this will interest you This is crucial because many consumers have suffered due to incorrect and unverifiable medical bills on their credit profiles. We should […]

September 21, 2023

Introduction: For those of you who’ve faced expensive medical challenges, the recent actions taken by the Consumer Financial Protection Bureau (CFPB) are a step further in […]

September 14, 2023

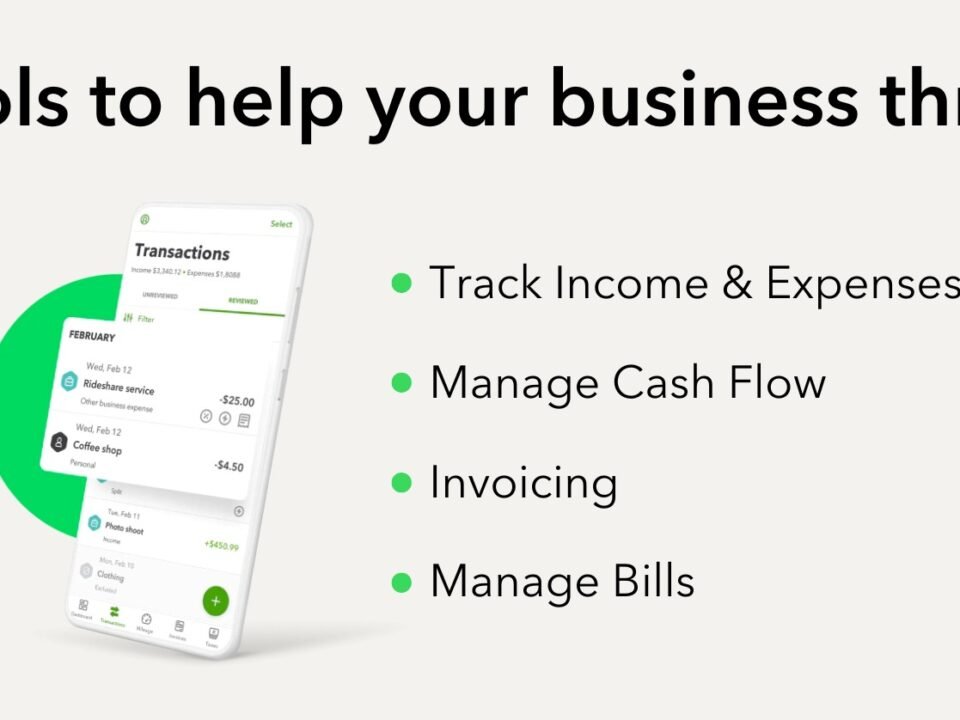

Did you know that managing your personal finances is a lot like managing your business finances? In today’s rapidly changing world, one thing remains constant: the […]

September 5, 2023

Hello, fellow financial explorers! 🌟 October is just around the corner, and with it comes an important change for millions of federal student loan borrowers. After […]

May 1, 2023

Your credit reports are full of information about you and your credit management habits. Some of those details can impact your credit scores for the positive, […]

September 23, 2022

Paying close attention to factors that can influence your credit scores is a smart move, especially considering their importance. Whether you want to open a new credit card, […]

September 16, 2022

If you’ve ever researched methods of improving your credit scores you undoubtedly found hundreds or thousands of articles with tidbits of advice. Ubiquitous to almost all […]

September 9, 2022

A decent credit score can open the door to many financial benefits. But, with just a “decent” score your options are still going to be capped. […]

September 4, 2022

On March 18th, 2022 Equifax, Experian and TransUnion issued a joint press release, which Equifax’s CEO, Mark Begor, posted on his LinkedIn page. The press release announced […]

September 3, 2022

When I write articles about credit I rarely give my personal opinions on the topic. I generally believe that adults should make adult decisions on their […]

August 28, 2022

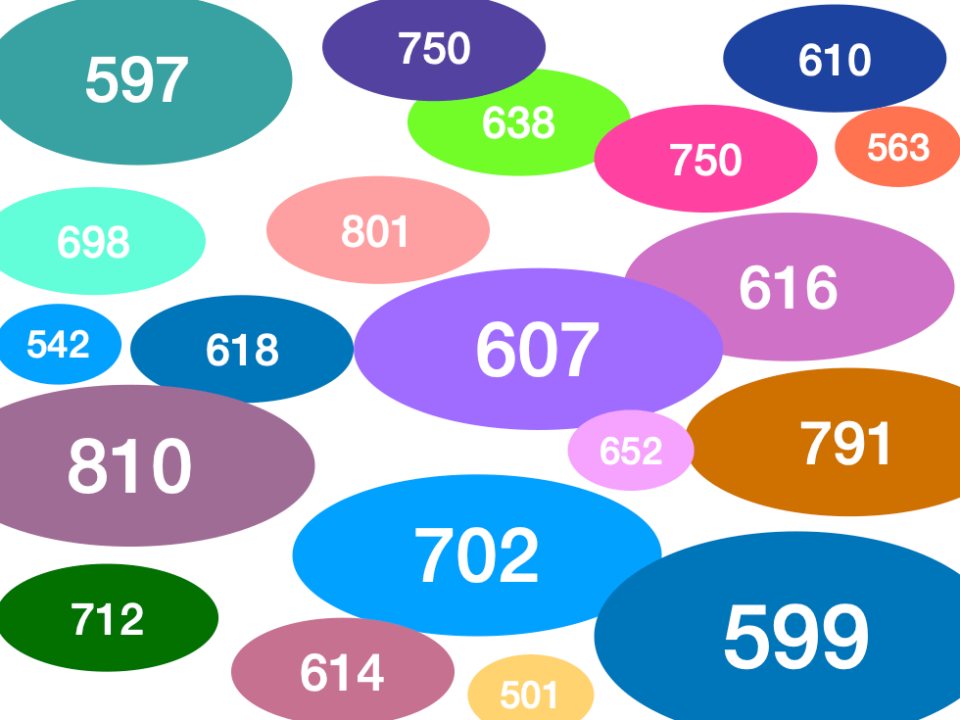

One of the most prevalent myths in the world of consumer credit is that we all have a single, three digit credit score. Nothing could be […]

August 21, 2022

Those of you who follow my writings, blogs, vlogs, and speaking engagements know I rarely give my personal opinions about credit-related issues. Whether it’s credit repair […]

August 14, 2022

Working to restore damaged credit scores is a little bit like solving a puzzle. People often look at their credit reports to find out what information […]

August 8, 2022

The world of credit is full of funny terms and acronyms that consumers may find confusing. One example is the term charge off. Some people see […]

August 1, 2022

If you research credit-building strategies, you’re sure to come across advice recommending that you work to add positive accounts to your credit reports. And while new […]

October 21, 2021

You already know that your credit scores help to determine whether a lender approves or denies your credit applications. Yet, just because you can qualify for […]

October 11, 2021

When you’re working to repair your credit, it makes sense that you might want to explore different methods and hopefully make the process more effective. However, […]

September 30, 2021

Working to rebuild damaged credit can be a long and often frustrating process. But there is a silver lining you can cling to if you’re working […]

September 22, 2021

Depending on the validity of their information, most sources indicate about 45% of marriages fail and end up in divorce. What this means is every single […]

September 14, 2021

Normally when I write about credit I do so in a very matter-of-fact manner. Here are the facts, A…B…C. I’m going to change it up for […]

September 6, 2021

Identity theft occurs when someone procures your personal information such as your name, address, Social Security number, and date of birth. The thieves then use this […]

September 1, 2021

You’ve done your best to stay current on your obligations. But, for whatever reason, you just can’t maintain your payment obligations. Eventually, some or several of […]

August 27, 2021

You apply for a new credit card and find out within a few minutes that your application has been approved. Congratulations! You’re about to get that […]

August 14, 2021

When you apply for new a new loan or credit card, the lender or card issuer will always check your credit report or reports as part […]

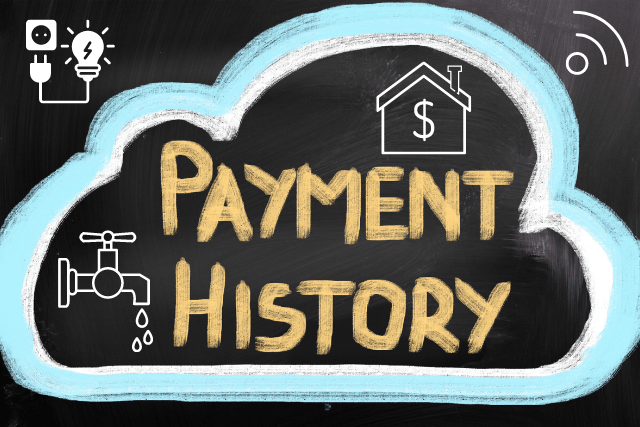

August 6, 2021

Paying credit obligations on time has the potential to help you establish solid credit reports and scores. This concept is easy enough to understand. But what […]

July 27, 2021

If you research credit-building strategies, you’re sure to come across advice recommending that you work to add positive accounts to your credit reports. And while new […]

July 21, 2021

The world of credit is full of funny terms and acronyms that consumers may find confusing. One example is the term charge off. Some people see […]

July 14, 2021

Working to restore damaged credit scores is a little bit like solving a puzzle. People often look at their credit reports to find out what information […]

July 8, 2021

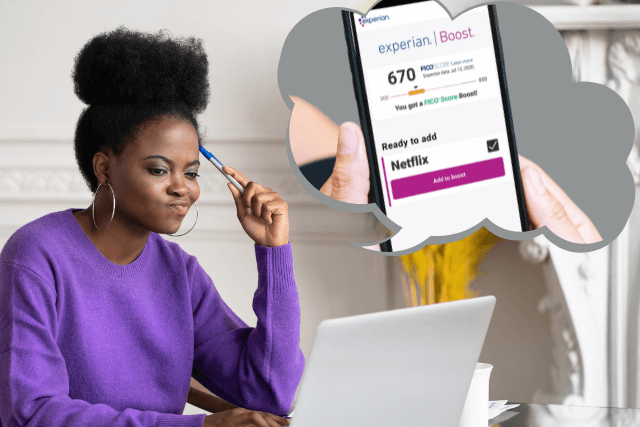

A decent credit score can open the door to many financial benefits. But, with just a “decent” score your options are still going to be capped. […]

July 2, 2021

Those of you who follow my writings, blogs, vlogs, and speaking engagements know I rarely give my personal opinions about credit-related issues. Whether it’s credit repair […]

June 29, 2021

On March 18th, 2022 Equifax, Experian and TransUnion issued a joint press release, which Equifax’s CEO, Mark Begor, posted on his LinkedIn page. The press release […]

June 20, 2021

One of the most prevalent myths in the world of consumer credit is that we all have a single, three digit credit score. Nothing could be […]

June 13, 2021

If you’ve ever researched methods of improving your credit scores you undoubtedly found hundreds or thousands of articles with tidbits of advice. Ubiquitous to almost all […]

June 6, 2021

When I write articles about credit I rarely give my personal opinions on the topic. I generally believe that adults should make adult decisions on their […]

June 1, 2021

Paying close attention to factors that can influence your credit scores is a smart move, especially considering their importance. Whether you want to open a new […]

May 28, 2021

Maintaining solid credit reports and scores is a valuable asset with the potential to save you money and make it easier to qualify for the things […]

May 20, 2021

With respect to our credit reports, every single one of us has something in common. We all enjoy considerable rights under the Fair Credit Reporting Act […]

May 14, 2021

The Fair Credit Reporting Act (hereafter, “FCRA”) affords each of us many rights as it pertains to our credit reports. One of those rights is the […]

May 7, 2021

Credit cards are without a doubt the most vilified of all of the credit products not called “payday loans.” Credit cards can influence your credit scores […]

April 22, 2021

In 2020, losses associated with identity fraud were $56 billion according to a study performed by Javelin. And, because of Covid 19 more consumers are remote […]

April 15, 2021

Your credit reports are so important to your personal bottom line. Accordingly, struggling with credit-related problems cannot be any fun. It’s certainly understandable to be annoyed […]

April 8, 2021

Working to improve bad credit is a wise use of your time and energy. Yet at the same time, cleaning up damaged credit may feel like […]

April 3, 2021

Consumers have long enjoyed the right to an accurate credit report. The Fair Credit Reporting Act, which has been around since the early 1970’s makes that […]

March 18, 2021

If you’re in the habit of checking your credit reports, then you’re aware that the information on your reports tends to change over time. New accounts […]

March 12, 2021

The world of consumer credit is filled with terms and phrases that are uncommon elsewhere. One such phrase is “re-aging.” Re-aging occurs when a certain date […]

March 5, 2021

There are many reasons you might want a better credit score. Perhaps you want to qualify for a new credit card or loan. Or, maybe you’re […]

March 2, 2021

When you fall behind on a debt, there are a number of bad things that can happen. Your creditor may charge you a late fee. With […]

February 24, 2021

Over 220 million Americans have consumer credit report information maintained by the three national credit reporting agencies, Equifax, Experian and TransUnion. This means over 660 million […]

February 18, 2021

When you’re working to improve your credit, the last thing you want to do is make a mistake and set back your progress. It’s also, however, […]

February 12, 2021

Identity theft is a crime that occurs when someone steals your personal information and uses it without your permission, sometimes to apply for new credit in […]

February 6, 2021

Keeping an eye on your credit reports and credit scores is a good financial habit. But if you’ve ever checked your variety of credit scores online […]

February 1, 2021

Good credit is a necessity if you want to make your financial life easier. Good credit can help you qualify for loans and credit cards at […]

January 22, 2021

When it comes to trying to improve your credit, there are a lot of different strategies you can employ. Some credit improvement techniques involve you paying […]

January 18, 2021

When mistakes show up on your credit reports, federal law gives you the right to request that the credit reporting agencies correct them. This request is […]

January 14, 2021

Sometimes people disagree with the information on their credit reports. And while this can be frustrating, the Fair Credit Reporting Act (FCRA) confers to you the […]

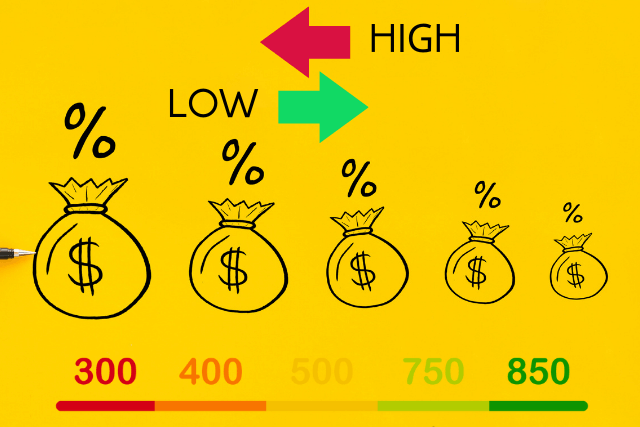

January 11, 2021

Credit scores, those three digit numbers ranging from 300 to 850, are used by almost every lender in the United States to support their lending operations. […]

January 4, 2021

The condition of your credit will have a profound impact on your overall financial well-being. Unfortunately, many of us can have credit-related setbacks, such as a […]